The market for NFTs is booming, with revenue flowing in. Still, the amount of money pouring into the industry doesn’t necessarily mean that there is an equally large number of users in the marketplace.

NFTs are a highly speculative market at times, with prices fluctuating based on the whims of influential individuals and communities. Take the instance Kapetta, a new anime-based NFT collection. Less than 24 hours after the announcement, which stated that “If you see this, you’re very early,” thousands of people were already following the page and were eager to invest.

There is beauty in how NFTs offer ease and convenience for many users to interact with digital art, both in the creation and trade of digital assets. Unfortunately, there is also a danger when assets entirely rely on speculation on a first-come, first-served basis.

NFT collections have those characteristics because potential investors and crypto enthusiasts have to always look for new collections. Being first means that you can get whitelisted and be one of the first people to invest in the new collection. Buying an NFT for thousands of dollars is nothing if you can sell it for millions once the hype around the collection reaches its peak.

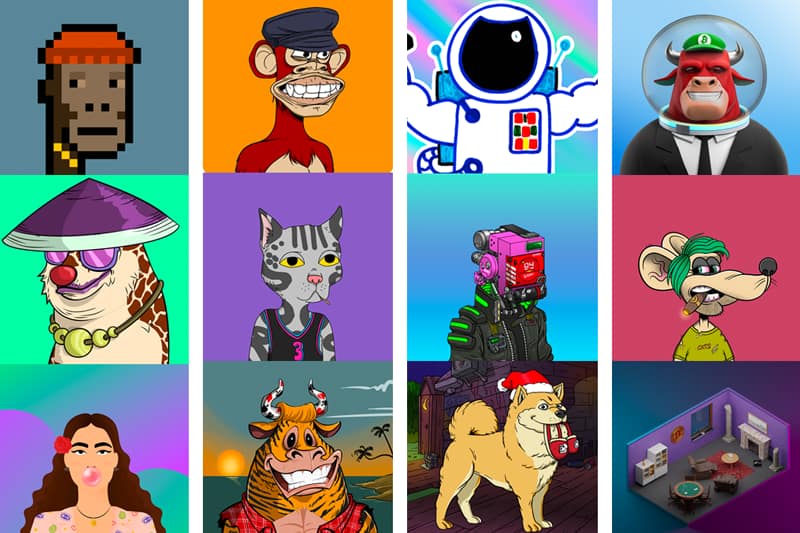

Crypto enthusiasts and ordinary people look at legendary NFT collections such as the Ape Yacht Club, which have sold NFTs for millions and have celebrities such as Eminem and Justin Bieber on their list. When they look at such cases of success, it’s easy to understand why they desperately hope that their next investment will be able to recreate that success hopefully.

This eagerness to invest can be problematic because it leads to a highly speculative market. Furthermore, it allows creators to earn profits on their NFT collections without necessarily providing a worthy product or giving any evidence that their product is legitimate.

The irony of Kapetta, the anime-inspired project, was a hoax. The scheme was intentionally designed by Roberto Nickson, who wanted to do a social experiment in the hopes of informing people that they shouldn’t jump too quickly into speculative markets. He warned against the recent cases of scams, rip-offs, or, as they are called in the NFT community, “rug pulls.”

“There is so much nonsense in this space right now.” claims Nickson and goes on to ask, Why are we normalizing giving anonymous internet people money?”

Nickson’s claims hold a lot of merits. NFTs have been around for years, but the real revolution that took over the world happened less than a year ago. There is a lot of potential to be seen in non-fungible tokens.

OpenSea, the largest marketplace for NFTs, has a value of more than $13 billion. Huge companies such as Twitter, Instagram, Ubisoft, Youtube, Nike, etc., have all promised to jump into the world of NFTs. Mainstream events such as the SuperBowl were turned into a “CryptoBowl” due to buying advertisement space by crypto trading platforms FTX and Coinbase. Crypto-specific companies, such as Yuga Labs, which created the Bored Ape Yacht Club, raise multi-billion dollar investments.

The market for NFTs is massive, but the attention from the public and celebrities doesn’t mean that it is without problems. Many NFT marketplaces face huge issues regarding copyright infringement, scams, and artificial inflation of prices. Regulations are necessary, but many platforms either turn a blind eye, enroll the necessary rules very slowly, or refuse to do so because it would cut their profits from the convenience that many users have.

Another problem with the NFT market is the relatively small user base compared to the money traded there. According to analysis from DappRadar, OpenSea has around half a million active users over the past month. Compare the small number of customers with the fact that OpenSea was trading around $100 million worth of Ethereum every day last month.

Suppose the user base in OpenSea is relatively tiny. In that case, you can imagine it’s even smaller in other NFT trading platforms, which are more niche or just smaller in size and popularity. Many reasons could explain why the market is currently so small for users.

First, many may be wary of jumping into the world of NFTs since it is a relatively new trend, and there are a lot of headlines about potential financial dangers and scams in the marketplace. Second, many don’t see the value of NFTs altogether and prefer other, more traditional methods of interacting with art. Third, some crypto enthusiasts know the importance of NFTs but prefer to stick to traditional cryptocurrencies when they are building their portfolios.

Finally, the massive amount of speculation and the market’s volatility could mean that NFTs are not accessible to many people. Many new collections require a considerable time investment to discover them and get whitelisted early. Furthermore, the speculative element means that prices are rising so fast that only those, such as wealthy crypto owners and venture capitalists, can safely invest.

Despite that, NFTs are an exciting opportunity to transform the digital world. Many people are not crazy about the potential profits NFTs can offer and prefer this new and accessible way to interact with art. To many users, having their unique digital avatar, which ties them to a specific identity and community, is hugely valuable.

Whether NFTs have a bright future or not is yet to be determined since the market is still in its very early stages. Digital revolutions, such as the rise of Twitter, which was also considered “niche” in the beginning, show that any new trend can change the internet forever with enough time.